Now more than ever, we’ve found that our vision for patient care can’t be achieved under insurance company mandates. It’s that simple.

Why is there actually more risk in being in network with every insurance carrier? I’ll tell you and it starts with the constraints we work under when accepting insurance reimbursement from many carriers and it goes something like this…

Insurance companies MANDATE limits to your treatment plans.

Insurance companies LIMIT number of visits you will receive each year.

Insurance companies DICTATE how much will be covered for your care (even if the amount doesn’t cover the cost for us to serve you best). In addition, healthcare providers have no say when in network with your insurance. The carriers without clinical expertise for your case make the decision on what service is allowed.

Insurance companies require more tedious paperwork and force us to work through their red tape BEFORE paying for the care you receive even if the services were ALREADY PROVIDED.

Insurance companies can REFUSE to reimburse you for your treatment if they don’t agree with the necessity of the treatment plan we’ve developed even after it’s been delivered and completed!

Insurance companies provide little to NO communication when coverage levels change and in all my years in private practice I’ve only experienced coverage and reimbursement DECREASES, never increases.

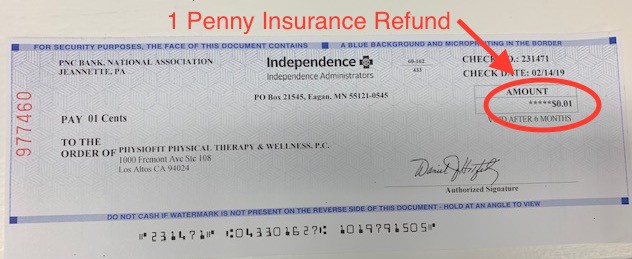

So much so, we recently received a reimbursement check for 1 penny as shown above.

In an eye-opening exclusive reported by CNN, it was revealed that former Aetna Medical Director, Dr. Jay Ken Iinuma, admitted under oath that “he never looked at patients’ records when deciding whether to approve or deny care.”

This admission was made during a deposition in a lawsuit brought against Aetna by Gillen Washington, a 23 year old with common variable immune deficiency (CVID) who was denied coverage for an infusion of intravenous immunoglobulin (IVIG) four years ago.

California’s insurance commissioner, Dave Jones, is now looking into Aetna’s relevant protocols.

The whole experience is about what benefits the Insurance Carrier…NOT you as the subscriber.

In the Single Payer Healthcare debate, the strongest argument against insurance companies control is that by denying coverage and choosing what to pay for, they are LITERALLY practicing medicine without a medical degree!

As physical therapists, we didn’t put countless hours into becoming an expert in our field to allow a third party payer to determine what’s best for OUR patients.

We have a vision for our practice, a set of goals for what we want to accomplish for our patients. That’s why we focus on what supports the needs of our patients rather than the needs of insurance companies. We deliver patient centered care rather than insurance carrier centered care. We are here to support you in what we believe to be the best way to get results quickly.

While PhysioFit is still in network with some insurances, many patients are more than happy to pay cash for physical therapy if it means receiving more personalized care. This allows PT’s to truly focus on providing exceptional patient care. With the proliferation of high-deductible health plans, insured patients often face high out-of-pocket costs, so there’s not a huge financial jump to move to cash-based services.

We believe it’s important to raise awareness by sharing this important information with you.

P.S. All patients, insured or uninsured, in network or out-of-network are welcome at PhysioFit.

Los Altos, CA

Los Altos, CA